Bitcoin (BTC) has remained range-bound since printing a new all-time high nearly a month ago, and market sentiment has gradually shifted toward caution. With the asset now trading around $104,000 following a recent 2% dip, key technical and on-chain data are flashing warnings—and opportunities.

At CryptaBlocks, our analysts are closely monitoring a major price level that may determine Bitcoin near-term direction.

The Importance of the $95,500–$97,000 Zone

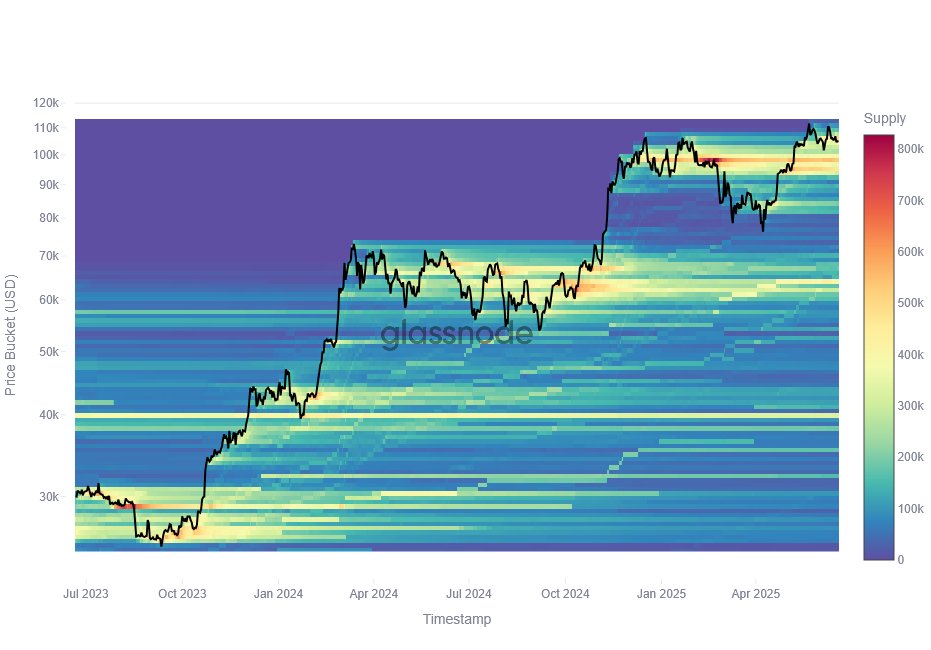

According to data from on-chain analytics platform Glassnode, Bitcoin’s Cost Basis Distribution (CBD) heatmap shows a dense supply cluster between $95,500 and $97,000. This area marks the first major Bitcoin support zone below current market prices and aligns with the short-term holder (STH) cost basis.

This technical confluence suggests a make-or-break zone: if BTC holds this level, bullish momentum could be restored. However, a break below $95,500 could accelerate downside pressure and ignite widespread liquidations, shaking out weak hands.

Why This Zone Matters for Investors

This isn’t just a technical level—this range is where thousands of BTC were last accumulated, which makes it a psychological stronghold. If bulls defend it, Bitcoin could stabilize and regain strength for another leg upward. But if this floor breaks, the sell-off could intensify, potentially driving prices as low as $93,000 or below.

Glassnode’s insight has been echoed by several market strategists, including notable macro observers who warn that Bitcoin may not be able to hold the $100,000 psychological level in the short term.

Market Overview: Bearish Pressure Mounts

Bitcoin is currently trading at $103,753, with a 1.27% weekly loss and a 6.10% decline on the monthly chart. Despite brief upward momentum between June 16 and 17, the overall trend suggests growing bearish control over the market. Rising global tensions and U.S. economic uncertainty have further clouded the short-term outlook for risk assets.

Still, with a $2.05 trillion market cap and a commanding 64.3% market dominance, Bitcoin remains the most resilient crypto asset—one that savvy investors are watching closely.

What’s Next for Bitcoin Investors?

CryptaBlocks analysts believe that holding the $95K–$97K Bitcoin support zone could reignite buyer interest, potentially putting BTC back on track for price discovery. For investors, this is a crucial time to observe price action closely, manage risk, and consider accumulation if key support holds.

Whether Bitcoin breaks down or bounces, one thing is clear: this Bitcooin support zone could determine the trajectory for the rest of the summer.

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

Ready to navigate market dynamics and optimize your crypto investments?