As we enter Q3 2025, the spotlight is back on Bitcoin, with historical post-halving data pointing toward a strong bullish run. CryptaBlocks analysts are closely monitoring these market signals, and the setup for another explosive rally appears to be forming.

Q3: The Launchpad for Bitcoin Bull Cycles

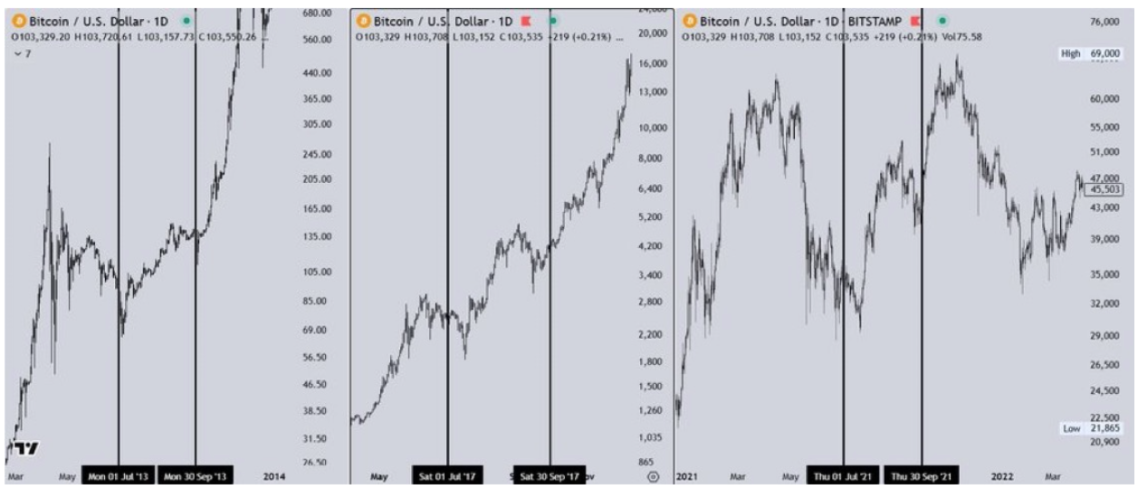

In Bitcoin’s past halving cycles—2013, 2017, and 2021—Q3 marked the beginning of massive upward movements. Historical data shows that each post-halving Q3 has delivered outsized gains. In 2013, BTC soared from under $100 to over $680. In 2017, it surged from below $2,800 to $16,000, and in 2021, a recovery from $39,000 culminated in an all-time high above $69,000 by Q4.

2025 is now following a similar trajectory.

Pattern Recognition: Why Q3 Matters

Recent analysis supports a bullish bias for the months ahead. According to aggregated data and technical structure, there’s no precedent for weakness in Q3 during any previous post-halving year. This consistency gives investors reason to expect Bitcoin to break out of its current range, setting sights on higher levels.

Bitcoin Price Outlook: $140K to $160K?

Technical projections suggest that the next potential BTC cycle top could land between $140,000 and $160,000. These Fibonacci extension targets align with strong historical momentum and ongoing accumulation patterns.

Bitcoin is currently trading just above $107,000, recovering from a previous dip. If history repeats itself, this could be the final accumulation window before Bitcoin enters full price discovery mode in Q3.

Investor Takeaway:

CryptaBlocks analysts believe Q3 could be pivotal for crypto investors. With post-halving trends, market structure, and on-chain data aligning, the conditions appear ripe for a renewed Bitcoin rally. As always, we advise disciplined entry, risk management, and staying informed via our updates.

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

Ready to navigate market dynamics and optimize your crypto investments?