Bitcoin (BTC) is trading just below the $120,000 mark, but recent Bitcoin miner activity on Binance suggests a potential short-term pullback. At CryptaBlocks, our analysts are closely monitoring on-chain signals to help investors navigate market volatility while maximizing ROI.

Miner Transfers to Binance Hit Multi-Month Highs

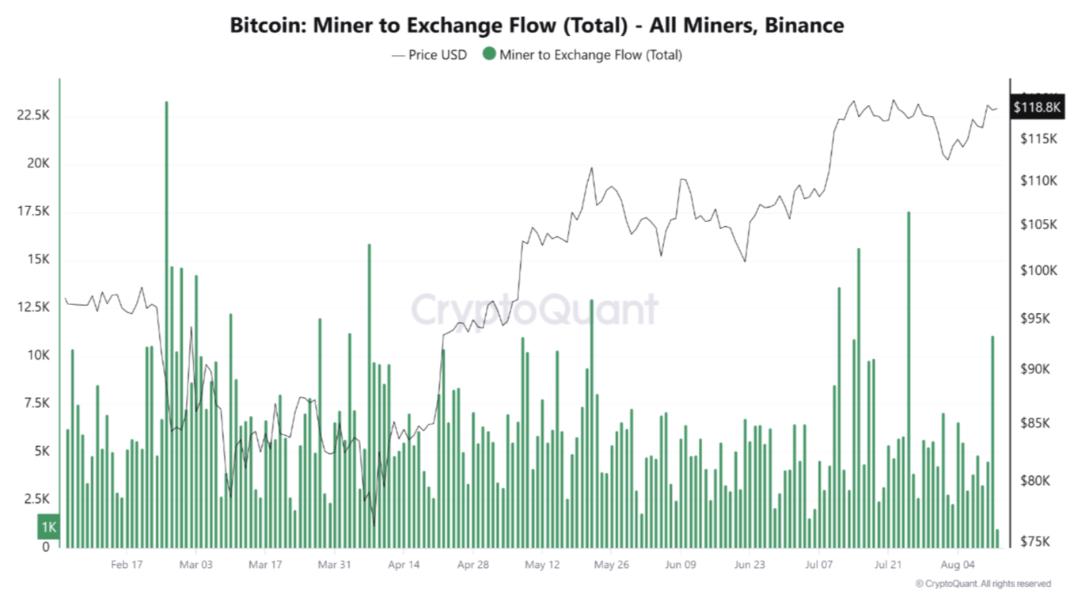

Late July saw a sharp increase in BTC transfers from miners to the Binance exchange, forming a “double-top” pattern on the charts. This was followed by several days of above-average inflows, with early August witnessing another spike — peaking at more than 10,000 BTC in a single day.

These elevated transfers suggest miners are securing liquidity while Bitcoin trades near its all-time high, a strategy that can help cover operational costs or manage post-halving treasury requirements.

Implications for Price Action

Sustained Bitcoin miner inflows often introduce short-term resistance in the market. The reason is simple: to maintain current price levels, there must be enough buying power to absorb the added supply. Without this liquidity, BTC becomes more vulnerable to a pullback.

Currently, daily inflows are ranging between 5,000 to 7,000 BTC — levels that could continue to pressure prices if sustained. Should these inflows drop quickly, it would signal that the selling phase has ended and that the market has absorbed the supply.

Market Still Shows Signs of Strength

Despite these headwinds, Bitcoin’s on-chain indicators do not suggest an overheated market. Futures order sizes are shrinking, indicating growing retail participation. Moreover, BTC’s consolidation near its ATH reflects strong investor confidence.

However, a large portion of short-term holders are in profit — a condition that can trigger selling, especially if miner distributions remain high.

CryptaBlocks’ Outlook

At CryptaBlocks, we believe the market is at a critical juncture. Sustained miner distributions could lead to a short-term dip, but the long-term trend remains bullish, especially if the supply overhang is absorbed. This environment calls for disciplined investment strategies and timely decision-making to capture maximum returns.

Our analysts will continue to monitor miner activity, liquidity conditions, and retail participation to guide our investors toward profitable opportunities in both bullish and corrective phases.

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

Ready to navigate market dynamics and optimize your crypto investments?