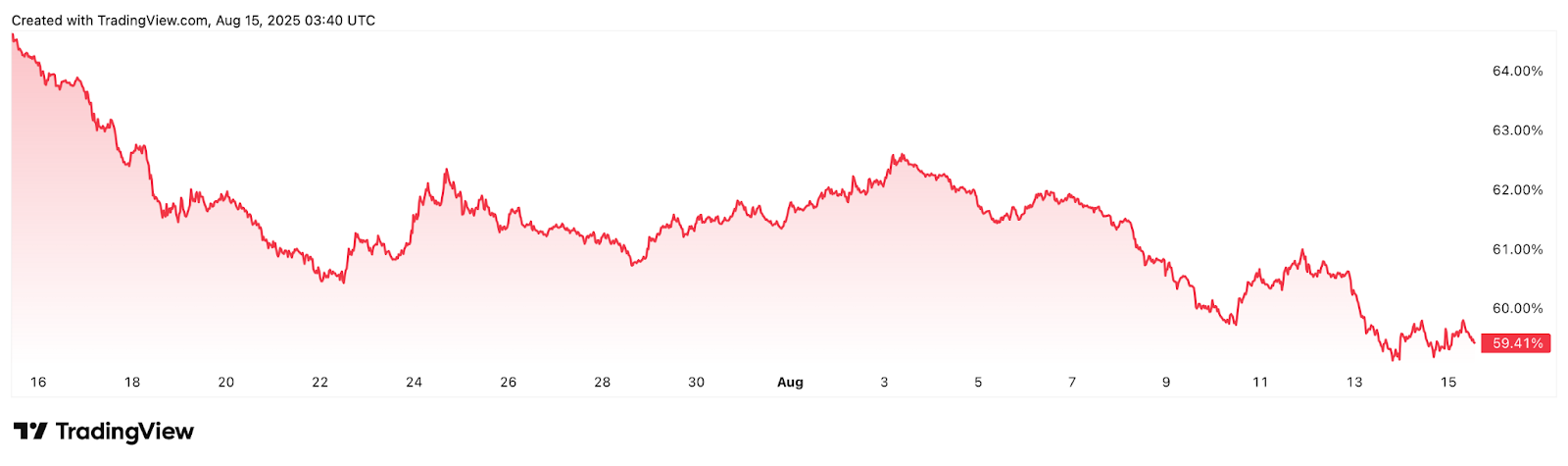

Bitcoin price action in August 2025 is beginning to resemble patterns last seen at its previous cycle peak in November 2021, when BTC reached $69,000. CryptaBlocks analysts note that the current Bitcoin chart structure — highlighted by what appears to be a double top pattern — is raising questions among traders about whether the market is approaching a short-term reversal.

In past cycles, such patterns have often preceded a period of consolidation or even downturn, particularly in post-halving years.

The 2021 Playbook — Will It Repeat?

Historically, Bitcoin’s post-halving market behavior has followed a rhythm: strong rallies into mid-year, pullbacks in September, and renewed surges into Q4 before cycle peaks. Current price action, moving upward into July–August, fits this model closely. Some traders argue this could mean a September dip before a potential Q4 high.

The Case Against Chart-Only Predictions

Not all analysts agree with relying solely on historical charts. CryptaBlocks’ review of on-chain and macro data supports a broader perspective: price action is increasingly influenced by large-scale Bitcoin treasury holdings. Currently, publicly traded Bitcoin treasury companies hold over $150 billion in BTC — a factor that could dampen or amplify market moves regardless of Bitcoin chart patterns.

Moreover, Ether’s strong performance — now within 6% of its all-time high — suggests that capital rotation into altcoins might not yet be signaling the start of a prolonged bear market.

CryptaBlocks Outlook for Investors

At CryptaBlocks, we believe investors should consider both historical market patterns and current fundamental drivers. While chart similarities to 2021 are worth noting, the unprecedented level of institutional holdings, along with ETH’s bullish momentum, suggest that the current cycle may not play out identically to past ones.

We recommend a balanced approach:

- Monitor key September price levels for pullback risks.

- Watch treasury company activity for signs of sustained buying or selling.

- Remain positioned for potential Q4 upside while protecting capital from short-term volatility.

Moreover, Ether’s strong performance — now within 6% of its all-time high — suggests that capital rotation into altcoins might not yet be signaling the start of a prolonged bear market.

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

Ready to navigate market dynamics and optimize your crypto investments?