Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

CryptaBlocks Outlook for Investors

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

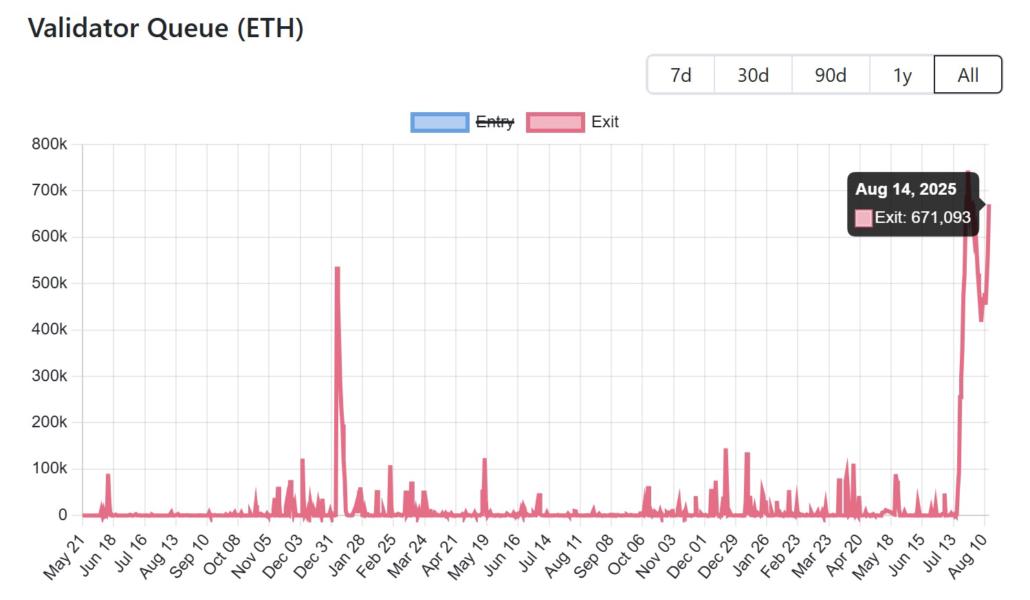

- Lido: 285,000 ETH

- EthFi: 134,000 ETH

- Coinbase: 113,000 ETH

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

CryptaBlocks Outlook for Investors

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

CryptaBlocks Outlook for Investors

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

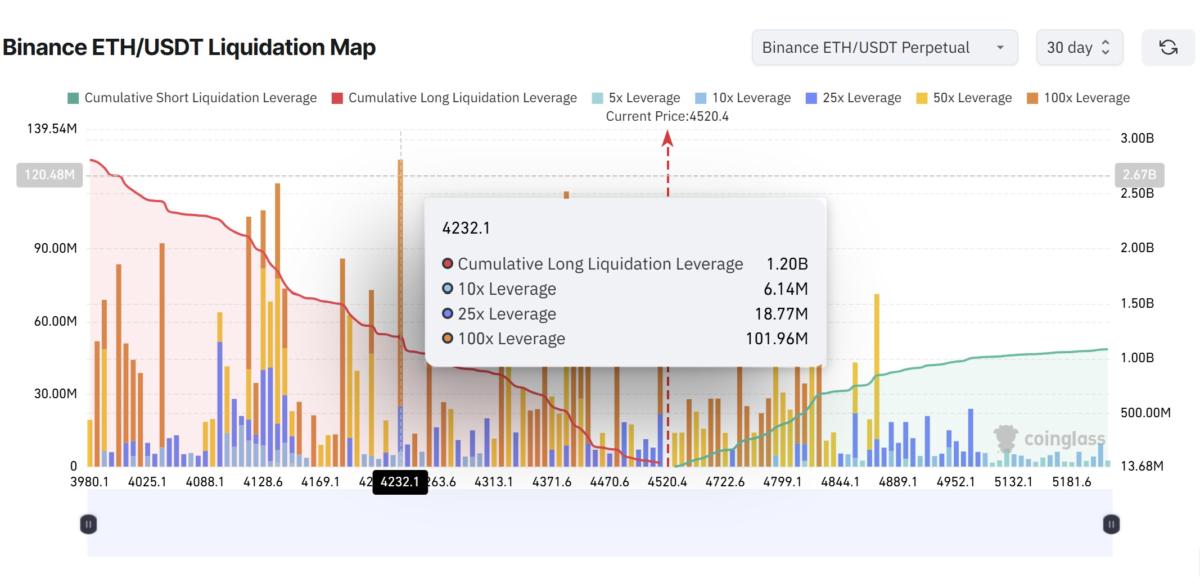

- Immediate support: $4,200, with $1.2B in long positions at risk if broken.

- Secondary support zone: $4,100–$3,900, aligned with the “golden zone” Fibonacci retracement and prior higher highs.

- Upside target: $5,000–$5,200, where liquidation clusters are building.

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

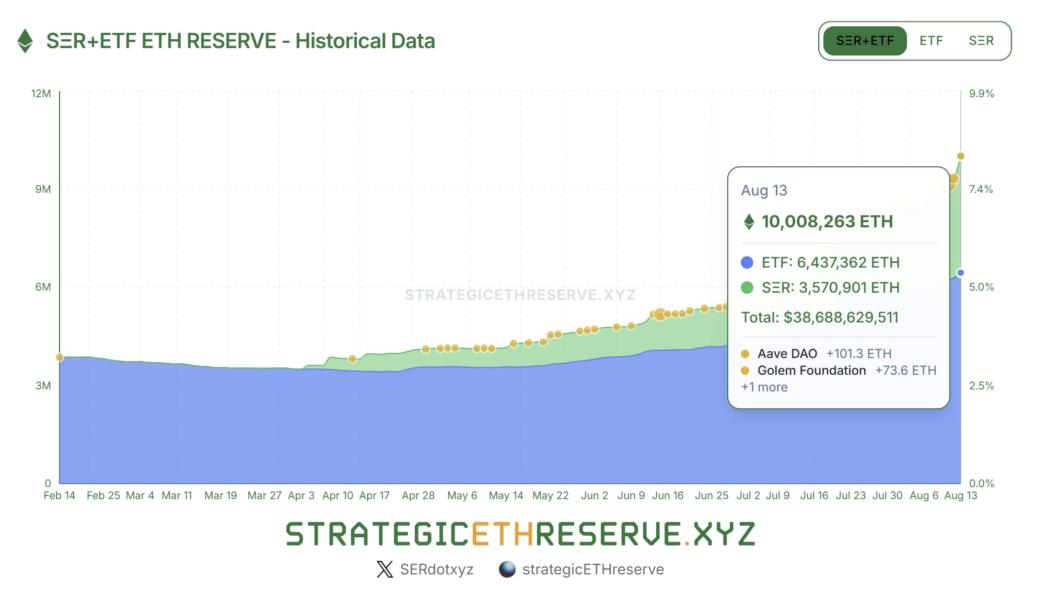

Looking Ahead: ETH ETFs and Market Impact

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

CryptaBlocks Outlook for Investors

The $3.8B Ether unstaking queue presents both risks and opportunities. If institutional flows continue, ETH is likely to remain resilient and prepare for another leg higher. However, a slowdown in inflows could amplify pressure at key support levels.

At CryptaBlocks, we advise investors to:

- Closely watch ETH’s $4,200 support.

- Monitor ETF and treasury flows for early signs of sustained accumulation.

- Prepare for volatility, but stay positioned for the long-term growth of Ethereum’s ecosystem.

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

Ready to navigate market dynamics and optimize your crypto investments?