Ether (ETH) recently endured a 15.1% drop over six days, briefly tagging $4,070 and wiping out $817 million in leveraged long positions. Despite this correction, ETH derivatives and futures data suggest traders are not panicking. Instead, professional investors appear to remain resilient, keeping $4,700 within reach if macroeconomic conditions stabilize.

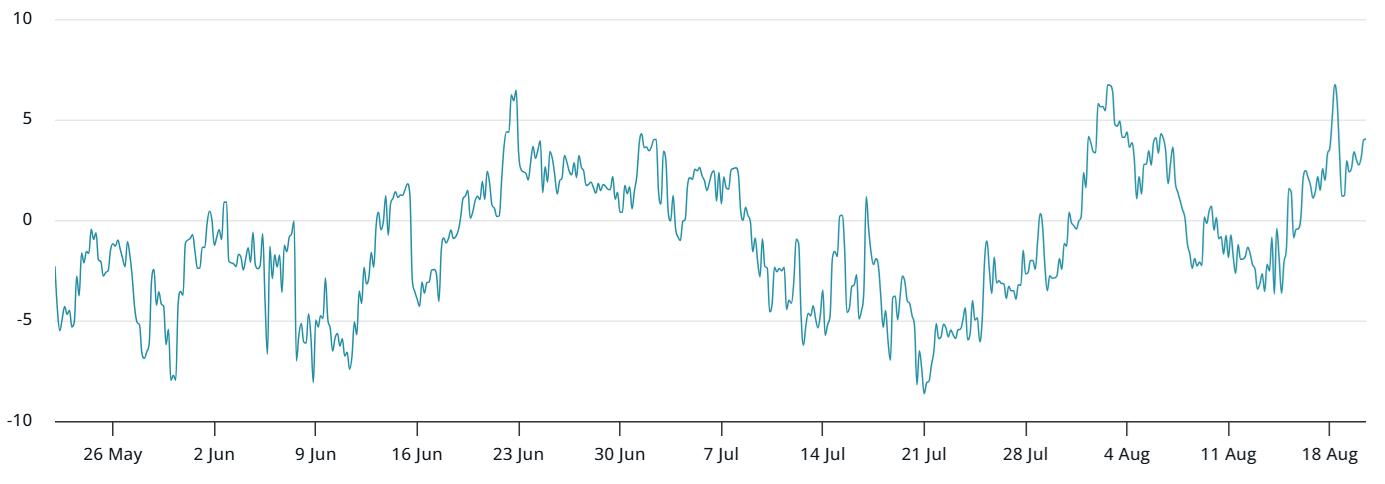

ETH Futures Premium Reflects Trader Confidence

The annualized futures premium stayed above 5%, a neutral-to-bullish signal, even during ETH’s decline. This shows that traders still expect higher prices in the medium term. Interestingly, despite ETH doubling between July 1 and August 13, derivatives sentiment never fully returned to the bullish levels seen earlier in the year, reflecting broader market caution.

Options markets confirm this neutral stance, with balanced demand for both puts and calls. In short, traders are wary of declaring a new all-time high but are not pricing in a sustained bearish turn either.

Macroeconomic Uncertainty Fuels Hesitation

Global macro factors continue to weigh on crypto sentiment. U.S. inflation remains above the Federal Reserve’s 2% target, while equity markets — especially tech stocks — are showing signs of fatigue. A more hawkish tone from the Fed or weaker earnings could add to investor caution.

This broader uncertainty explains why ETH futures reflect caution, even as the asset shows resilience.

Onchain Activity Tells a Bullish Story

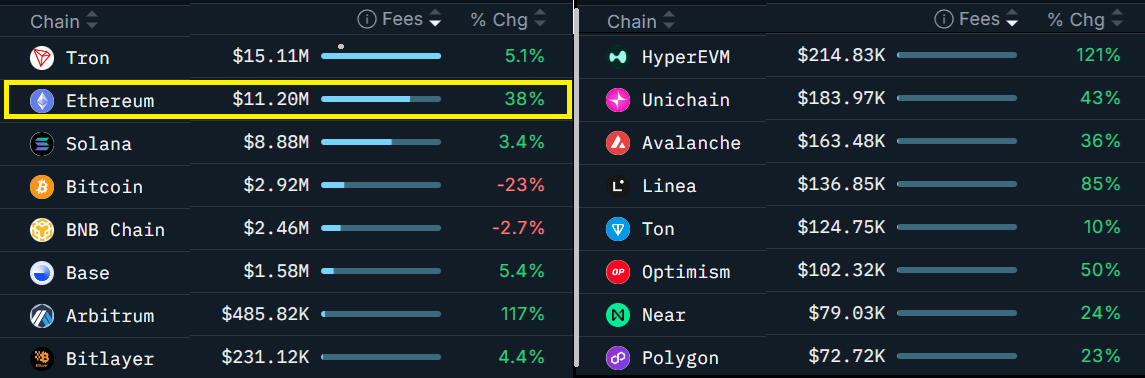

While derivatives show restraint, Ethereum’s onchain metrics highlight strength:

- Ethereum maintains ~60% dominance in total value locked (TVL).

- Network fees surged 38% in one week, reaching $11.2 million.

- DEX volumes hit $129.7 billion in 30 days, far outpacing competitors.

For comparison, Solana’s fees rose just 3%, while BNB Chain saw a 3% decline. This divergence underlines Ethereum’s continued dominance in DeFi and its rising demand for blockspace — both positive long-term signals for ETH price recovery.

CryptaBlocks Outlook for Investors

At CryptaBlocks, we believe ETH’s recovery potential remains solid despite cautious futures data. The futures market reflects fear of macroeconomic risks, not Ethereum’s fundamentals. Onchain activity points to a strong ecosystem that continues to attract demand and capital.

Investors should watch ETH’s $4,070–$4,200 support range, as holding this zone could fuel a move back toward $4,700 and beyond once macro fears ease. For long-term holders, Ethereum’s dominance in fees, TVL, and DeFi positions it well to lead the next wave of crypto adoption.

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

Ready to navigate market dynamics and optimize your crypto investments?