Bitcoin price action this week highlights the battle between dip buyers and sellers as the world’s leading cryptocurrency struggles to reclaim the $112,000 level. While retail and institutional investors continue to accumulate BTC, upcoming macroeconomic data could determine the next decisive move.

Dip Buyers Step In

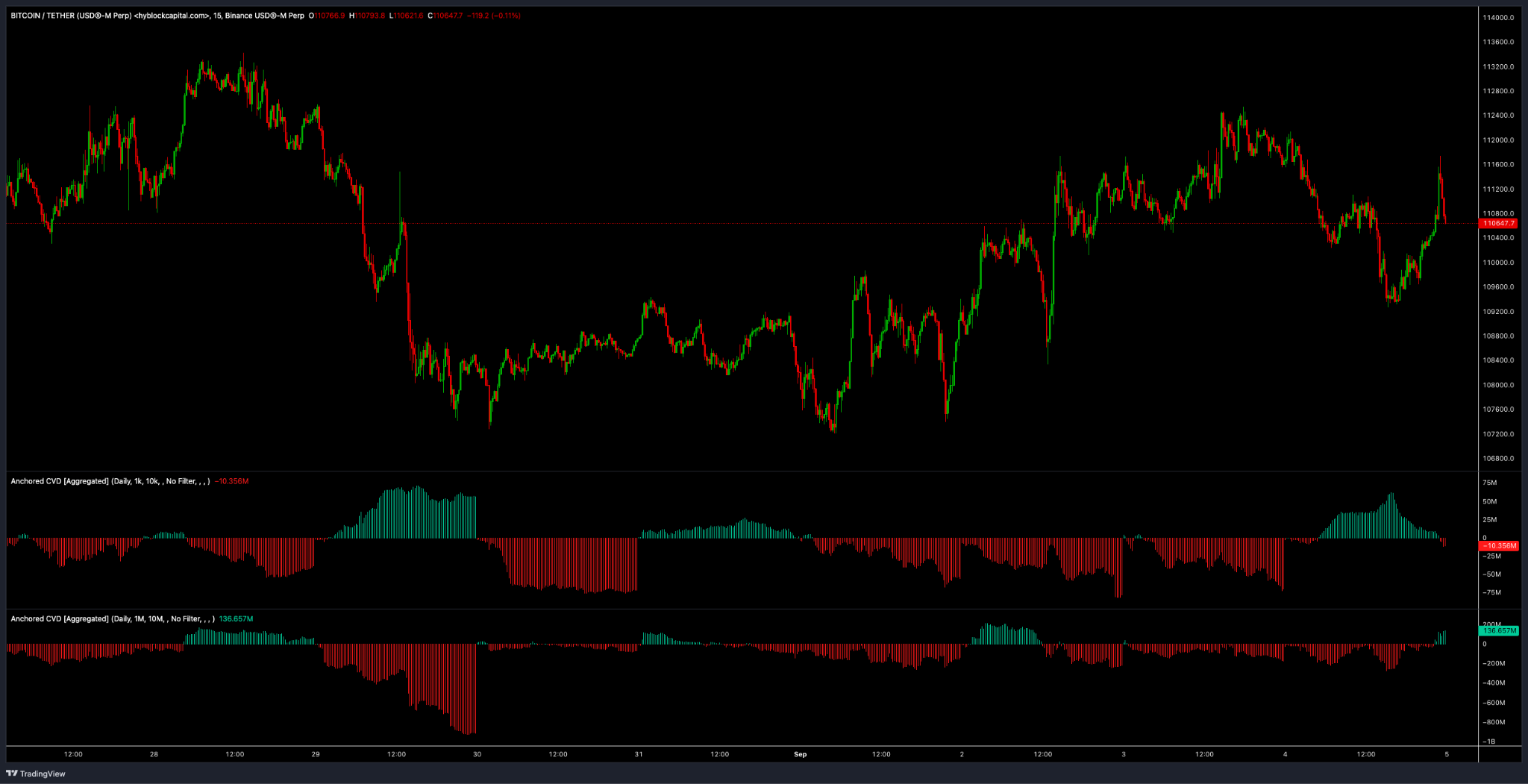

Data from the spot markets shows both retail and institutional traders taking advantage of lower prices to increase exposure to Bitcoin. After rallying to $112,600, BTC quickly reversed as sellers stepped in during the Asian trading session, pushing the price as low as $109,329.

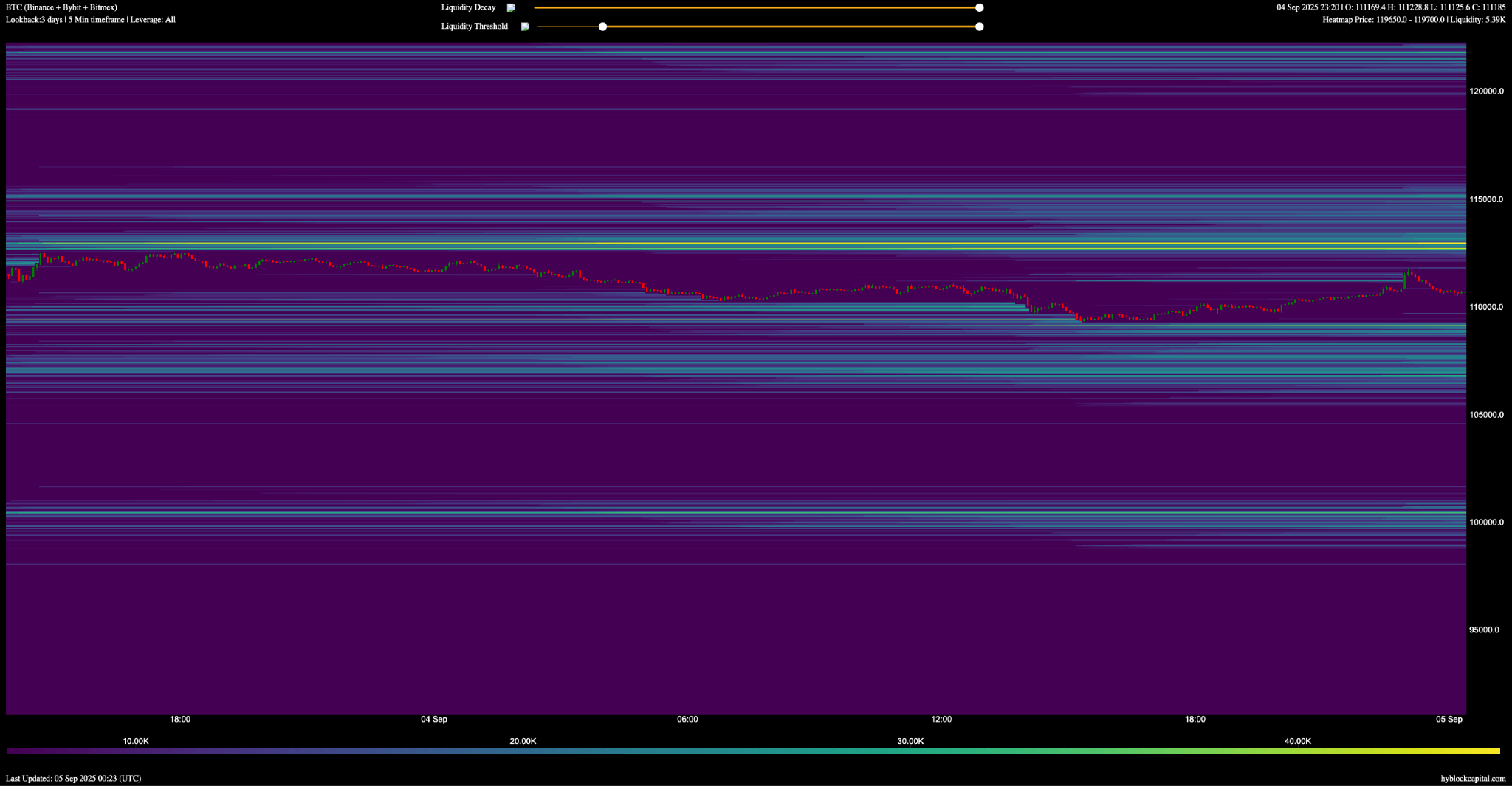

Short-term liquidation data indicates that BTC remains tightly bound between $109,000 and $111,200, with profit-taking by leveraged traders adding to the pressure.

US Jobs Report: A Key Market Catalyst

The crypto market is now closely watching the U.S. labor market for its impact on monetary policy. Wednesday’s weaker-than-expected ADP private hiring data — 54,000 jobs versus the anticipated 75,000 — rattled traditional markets.

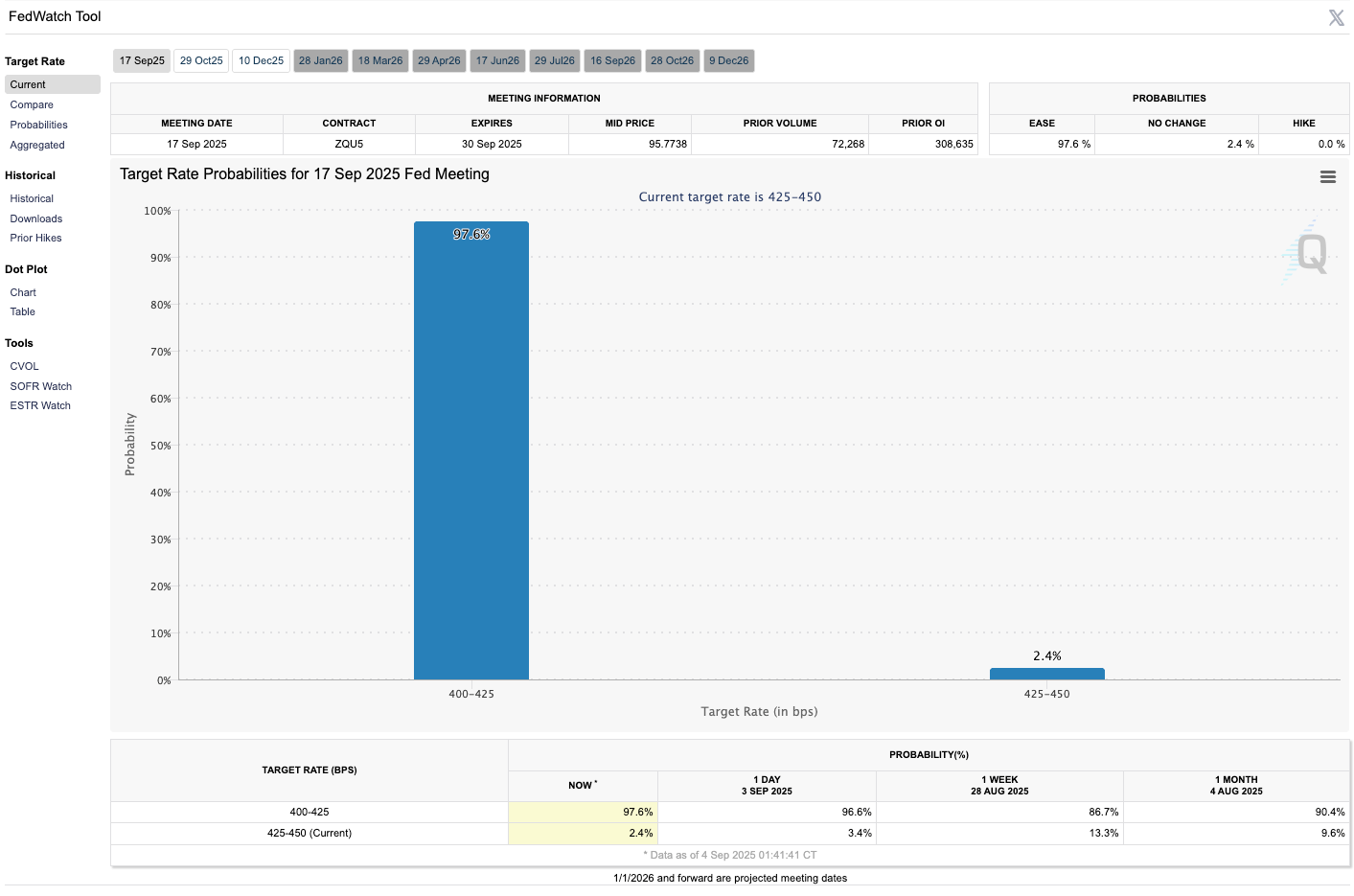

More significantly, the U.S. jobs report due Friday is expected to show around 80,000 new jobs. If the figure disappoints, it could signal a cooling economy and strengthen the case for the Federal Reserve to cut interest rates at its September meeting.

The CME FedWatch Tool already shows a 97.6% probability of a 25-basis-point rate cut, a move that many Bitcoin traders believe could spark a turnaround in price momentum.

Bitcoin’s Path Forward

Despite volatility, dip buyers continue to accumulate, indicating confidence in Bitcoin’s long-term value. A decisive daily close above $112,000 would strengthen the bullish case and potentially open the path toward retesting higher levels.

However, failure to reclaim this key level, coupled with weak labor data, may lead to further short-term downside. For disciplined investors, these swings present opportunities to position strategically for Bitcoin’s next move.

CryptaBlocks Insight

At CryptaBlocks, our analysts track both on-chain and macroeconomic signals to help investors navigate uncertainty and capture long-term ROI. While volatility is inevitable, Bitcoin’s fundamental adoption story remains intact, and short-term dips often create the foundation for future gains.

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

Ready to navigate market dynamics and optimize your crypto investments?