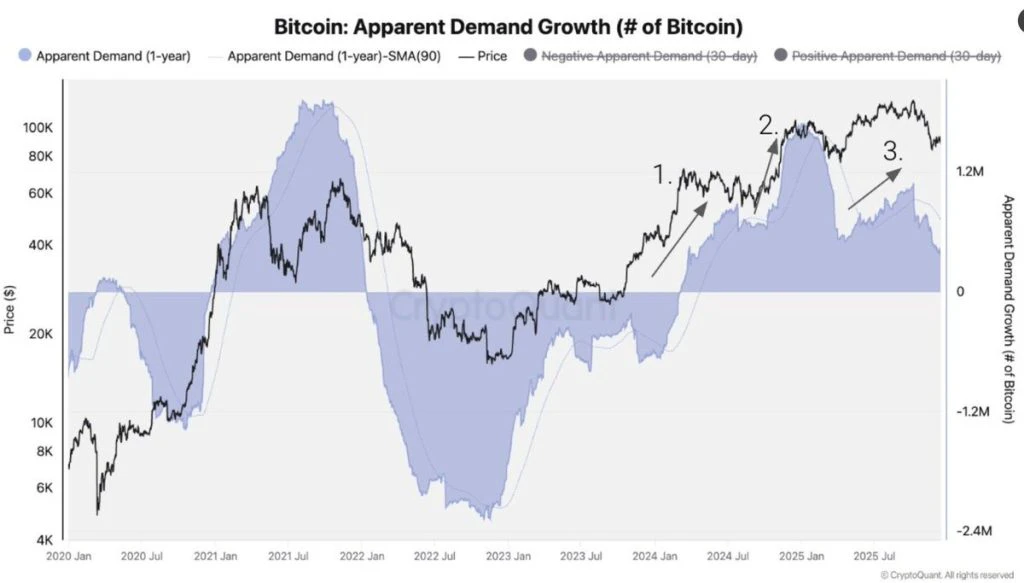

Bitcoin’s price may appear calm on the surface, but beneath the tight trading range, market structure is quietly shifting. As leveraged long positions climb to multi-month highs and demand growth begins to flatten, Bitcoin is entering a fragile equilibrium—one where positioning risk matters more than price action itself.

Bitcoin Price Consolidation Is Masking Structural Risk

Since early December, Bitcoin has traded sideways between the $85,000 and $90,000 region, with shrinking daily ranges and declining volatility. This compression signals balance—but not necessarily safety.

When volatility contracts for extended periods, markets become increasingly sensitive to shifts in trader behaviour. In such environments, positioning and demand dynamics often dictate the next move, not momentum indicators.

Currently, Bitcoin’s price is holding its range, but the underlying structure is becoming less forgiving.

Bitcoin Long Positioning Hits Multi-Week Highs

One of the most notable developments is the sharp rise in Bitcoin long positioning. Long exposure has climbed to its highest level in over 22 weeks, indicating that traders are positioning aggressively for upside before confirmation.

Historically, this pattern carries risk.

Our analysis shows a recurring inverse relationship between excessive long positioning and short-term price performance. Periods where longs spike often coincide with local pullbacks, while healthier price recoveries tend to emerge after leverage is reduced.

Today, Bitcoin longs are elevated while price remains near the lower boundary of its range—an imbalance that increases downside sensitivity if momentum fails to materialize.

Why Rising Longs Without Demand Expansion Is a Red Flag

Under normal bullish conditions, expanding demand absorbs leveraged risk. New buyers step in, offsetting profit-taking and preventing sharp corrections.

However, current data suggests that Bitcoin demand growth is no longer accelerating. While demand has not collapsed, the absence of expansion removes a critical buffer that typically supports price during periods of heavy positioning.

When demand stalls:

- Price becomes more reactive to liquidation events

- Crowded trades become unstable

- The market begins to punish anticipation rather than reward it

This is why the current setup is particularly fragile. Bitcoin is not weak—but it is exposed.

Two Likely Scenarios From Here

With volatility compressed, stretched positioning, and flat demand, the market typically resolves in one of two ways:

- A Sharp Corrective Flush: A breakdown below key support triggers long liquidations, resetting leverage and allowing stronger hands to re-enter at lower levels.

- Extended Sideways Grind: Price continues ranging, slowly exhausting impatient long traders before a more sustainable directional move develops.

In both scenarios, the immediate upside becomes limited until leverage is cleared or demand re-accelerates.

Key Bitcoin Support Levels to Watch

From a structural perspective, the $83,000–$82,000 zone remains critical. A clean loss of this region would likely expose Bitcoin to a deeper retracement toward $78,000–$75,000—levels where historical demand has previously stepped in with conviction.

These zones are not predictive targets but areas where market behaviour is likely to shift. How Bitcoin reacts there will determine whether the broader bullish structure remains intact.

Stay tuned to our updates as we continue to analyze these developments and provide actionable insights for your investment strategy.

Ready to navigate market dynamics and optimize your crypto investments?