Bitcoin relentless climb continues as it edges closer to the elusive $100,000 milestone, a psychological barrier that has investors and analysts on the edge of their seats. As of November 25, Bitcoin has hit an all-time high of $99,800, with significant market demand fueling this historic surge. However, beneath the surface of this bullish momentum lies a cautionary tale of record profit-taking, as Bitcoin Realized Profit reached a staggering $443 million on November 22.

So, what does this mean for the Bitcoin price trajectory? Is the cryptocurrency about to break through $100,000, or is this the signal of a local top? Let’s break it down.

Realized Profit Hits Record High

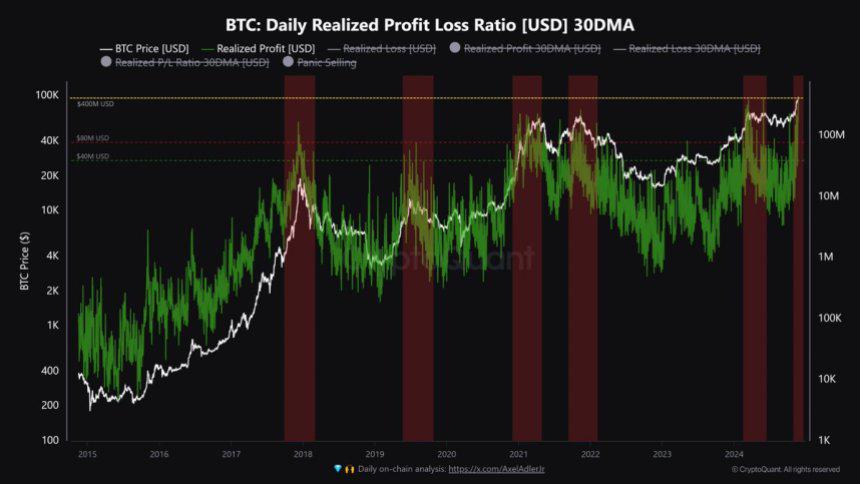

Bitcoin Realized Profit has surged to an unprecedented daily total of $443 million, according to CryptoQuant data. This increase in realized profits signals that traders and long-term holders are locking in gains, which has driven up market activity. While this sounds like a positive sign, it has led to mixed interpretations within the crypto community.

On one hand, this massive profit-taking reinforces the idea that Bitcoin is in a bullish phase—especially with demand staying strong and prices holding above key support levels. On the other hand, the surge in realized profits could point to a potential pause in Bitcoin’s rally. As market participants cash out, it’s possible we may see some short-term consolidation or even a price pullback.

Is Bitcoin at a Local Top?

As Bitcoin nears $100,000, the growing concern among some investors is that this could be a “local top” for the cryptocurrency. The surge in realized profits, paired with a slight dip in momentum, has led to speculation that the rally could stall before a breakthrough above the $100K level. If Bitcoin fails to sustain the $97,000–$98,000 range, a healthy price correction may be imminent.

A pullback to the $92,000 level is seen as a strong support zone, where Bitcoin could consolidate and prepare for its next major push. This potential correction could also create room for altcoins to recover and set their own rallies in motion.

Bullish Continuation: A Break Above $100K?

Despite these concerns, the overall market sentiment remains bullish. Bitcoin’s remarkable rally from $66,800 to $99,800 in just a few weeks reflects strong market confidence and demand. For many analysts, it seems inevitable that Bitcoin will eventually breach the $100,000 mark, opening the door to a new leg of its bull run.

Bitcoin has demonstrated resilience in holding above key levels, with the $95,000 mark providing strong support. As long as Bitcoin maintains this level, the likelihood of a breakout above $100K remains high.

For investors, it’s crucial to stay informed and monitor market conditions closely. At CryptaBlocks, we track market movements to help you stay ahead of trends. Whether Bitcoin experiences a short-term correction or continues its rally toward new highs, our suite of crypto investment services can guide you through every step.

Conclusion: A Critical Moment for Bitcoin

As Bitcoin sits just shy of $100,000, it is navigating a critical juncture. Will the market surge past the $100K barrier, or is a correction on the horizon? While the Realized Profit peak raises concerns of a local top, Bitcoin’s strong demand and technical indicators suggest the rally has room to continue. For investors, the key is to stay prepared for volatility and keep a long-term perspective on Bitcoin’s path.

At CryptaBlocks, we are committed to helping you navigate the ever-changing crypto landscape, making sure your investment strategy remains aligned with your goals. Whether you’re holding Bitcoin or diversifying into altcoins, we are here to help you maximize your ROI.