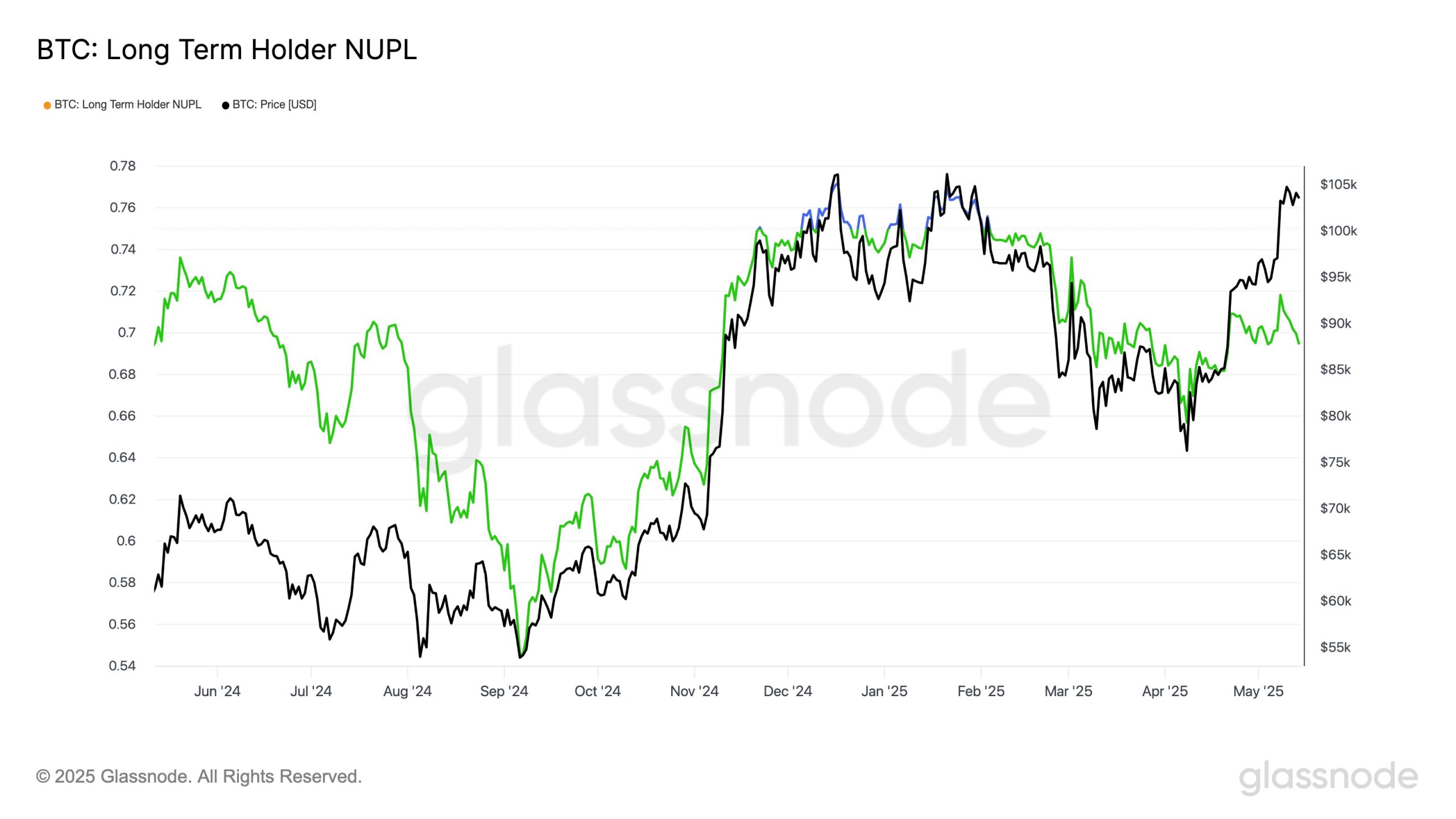

Bitcoin price has jumped from $85,000 to over $103,000, yet on‑chain data reveals that long‑term holder profits—as measured by the BTC Long‑Term Holder NUPL—remain unchanged at 0.69. What’s driving this dilution of gains, and what does it mean for market outlook? At CryptaBlocks, we break down the underlying mechanics of this key metric and its implications for investors.

What Is Long‑Term Holder NUPL?

Net Unrealized Profit/Loss (NUPL) tracks the difference between unrealized profits and losses across specific cohorts. The BTC Long‑Term Holder NUPL focuses on investors who acquired BTC at least 155 days ago. When this metric is positive, the average HODLer is in profit; below zero, they’re underwater.

Why Has NUPL Stayed Flat at 0.69?

Despite an $18K price gain, the LTH NUPL hasn’t budged. The reason: cohort dilution. As new buyers from December 2024 cross the 155‑day threshold, they join the HODL group at higher acquisition costs. Their relatively smaller unrealized gains offset older members’ profits, keeping the overall NUPL level steady.

Interpreting the Retracement Amid Price Sideways Action

Even as BTC traded sideways, the NUPL retraced sharply. This reflects the changing composition of the holder cohort rather than waning market strength—new entrants with smaller gains temper the average profitability, signaling that raw price moves don’t always equate to increased HODLer health.

Implications for Investors

- Cohort Analysis Matters: Relying solely on price can mislead—monitor how holder composition affects profitability metrics.

- Market Sentiment Gauge: A stable LTH NUPL around 0.69 suggests that long‑term investor confidence remains intact even as new participants dilute average gains.

- Strategic Timing: Use NUPL alongside price and volume to time entries, identifying when long‑term holders flip into PnL extremes

Conclusion

The static BTC Long‑Term Holder NUPL at 0.69, despite a substantial price rally, underscores the importance of cohort dynamics in on‑chain analysis. At CryptaBlocks, we integrate these insights into our investment strategies, helping you navigate nuanced market signals to maximize ROI.

Explore CryptaBlocks data‑driven investment strategies and stay ahead with real‑time on‑chain analytics tailored for investors.

Ready to navigate market dynamics and optimize your crypto investments?