Yesterday, Bitcoin (BTC) surged to a new all-time high (ATH) of $111,880 on Binance, up more than 45% from its April 6 low of roughly $76,000. Yet behind this impressive rally lie mixed whale reactions—and understanding these on-chain dynamics is key to positioning your portfolio for both short-term resilience and mid-term upside.

Bitcoin Whale Reactions: Profit-Taking vs. HODLing

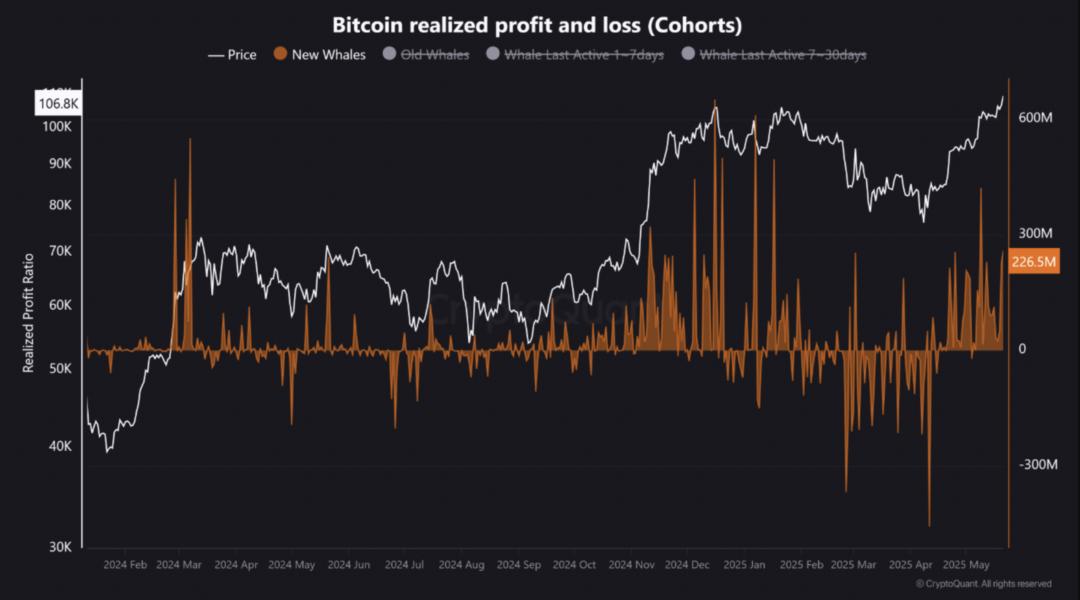

New Whales Taking Profits:

Recent data from CryptoQuant highlights that new whales—addresses holding BTC for under 30 days—have been actively cashing out, increasing selling pressure as prices peak. This profit-taking could foreshadow short-term pullbacks, especially if supply outpaces fresh demand.

Old Whales Stay the Course:

In contrast, old whales, those holding coins for over six months, have exhibited minimal selling. Their continued accumulation underscores long-term confidence in Bitcoin’s bullish trajectory and suggests that fundamental conviction remains strong despite near-ATH prices.

Moderate Activity from Mid-Term Whales:

Whales with 7–30 days holding periods are taking a more cautious approach: moderate profit-taking that reflects both recognition of gains and wariness of overextension. This restrained behavior hints at a market still balancing euphoria and prudence.

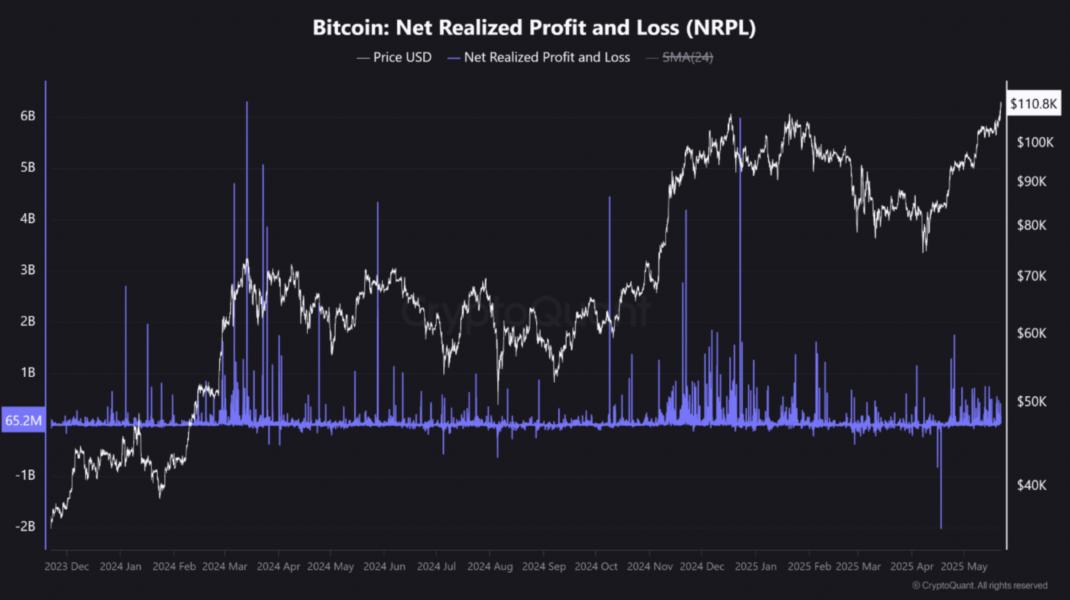

Net Realized Profit/Loss Indicates Cooler Momentum

The Net Realized Profit/Loss (NRPL) during this rally remains notably below levels seen at previous market peaks. Because NRPL measures the net profit or loss locked in by sellers, a relatively low NRPL suggests that widespread profit-taking hasn’t yet reached fever-pitch levels—potentially a healthy sign, but also a caution flag on rally sustainability.

Short-Term Correction vs. Mid-Term Continuation

- Short-Term Outlook: Given aggressive profit-taking by new whales, a pullback toward the $100,000–$105,000 support zone could materialize to absorb excess selling pressure and re-establish healthier buying conditions.

- Mid-Term Outlook: The steadfast positions of old whales, combined with muted NRPL, point to a strong foundation for renewed upward momentum following any consolidation. Pullbacks may present accumulation opportunities for savvy investors.

Net Realized Profit/Loss Indicates Cooler Momentum

CryptaBlocks analysts interpret these Bitcoin whale reactions as a dual-phase signal: prepare for possible short-term corrections but stay alert for renewed bullish advances in the medium term. Long-term holders remain confident, and suppressed NRPL indicates that the market may not yet be exhausted—setting the stage for further gains once volatility stabilizes.

Position yourself for what’s next in Bitcoin journey. Explore CryptaBlocks’ suite of crypto investment strategies and subscribe to our market alerts for real-time insights directly from our analysts.

Ready to navigate market dynamics and optimize your crypto investments?