Bitcoin recent surge toward all-time highs is losing steam. On May 28, 2025, Bitcoin dips below $108,000 amid evaporating rate-cut hopes from the U.S. Federal Reserve, raising critical questions for traders and investors alike.

Fed Rate Cut Bets Fade – Markets React

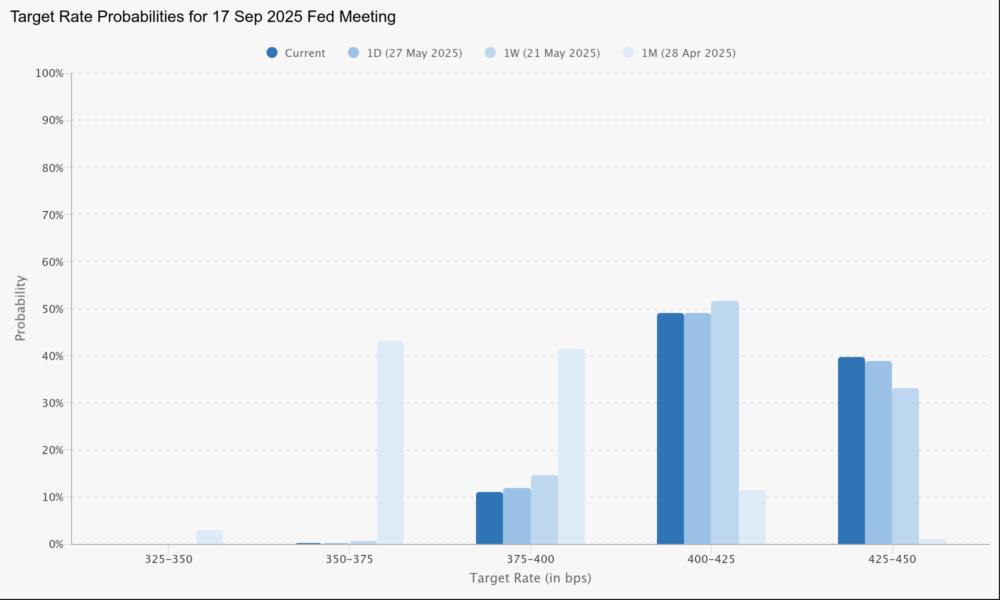

The cautious mood in risk assets has intensified. Data from Cointelegraph Markets Pro and TradingView confirmed Bitcoin dips below $108K, with macro indicators suggesting fewer Fed rate cuts in 2025. According to CME Group’s FedWatch Tool, expectations for a September rate cut are dwindling, while informal sentiment from Kalshi now projects just two cuts this year—down from four in early April.

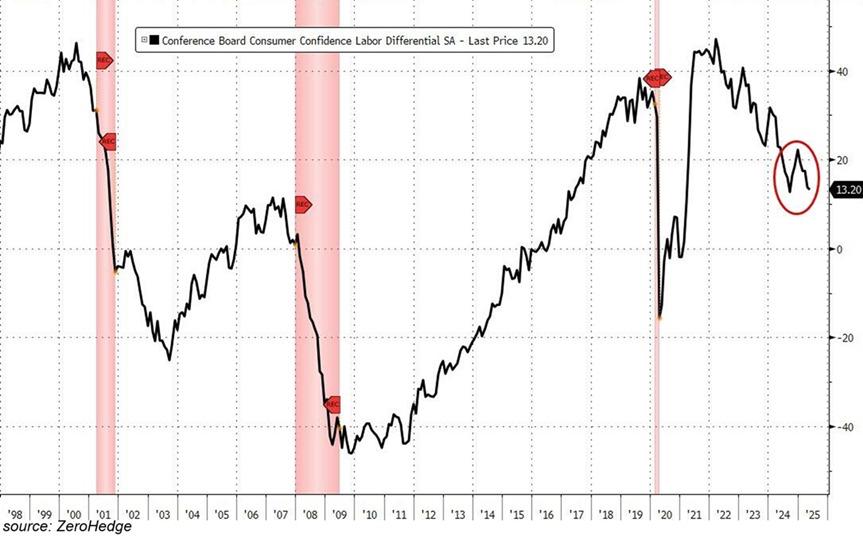

This shift underscores a fundamental change in market dynamics. With the labor market weakening, consumer sentiment indicates potential unemployment spikes, which could eventually force the Fed’s hand. However, until such catalysts materialize, Bitcoin remains vulnerable to downside pressure.

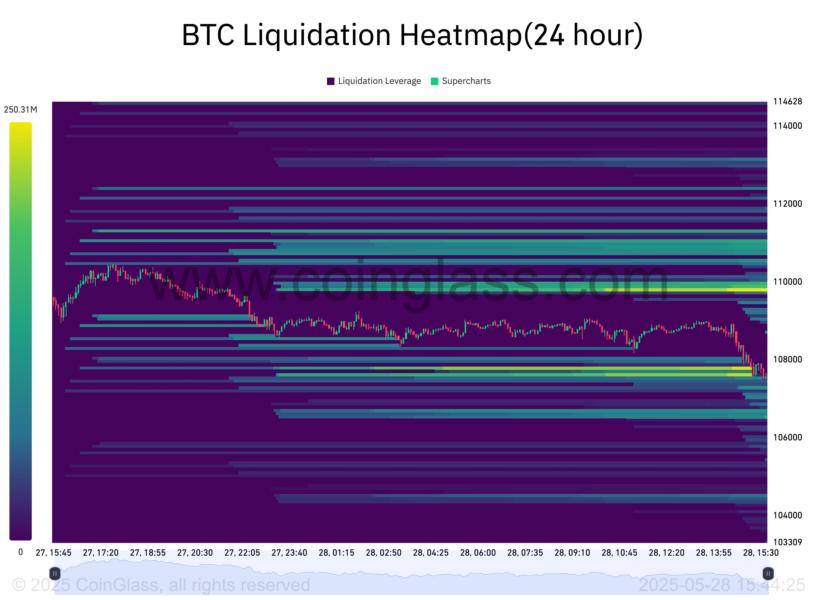

Bid Liquidity and Liquidation Walls

A concerning factor is the bid liquidity structure. BTC sliced through buy-side liquidity, exposing it to further downside risk. Notably, traders like TheKingfisher have highlighted an imbalance above $108,900, where a “massive wall” of short liquidations could act as a near-term volatility trigger if the price rebounds.

On the other hand, if price continues to drift lower, Bitcoin may probe even deeper levels of support, particularly in the $105,000–$106,000 range, where prior consolidation provided a temporary floor.

Market Volatility Lacks a Catalyst

QCP Capital’s macro analysis paints a picture of an increasingly desensitized market. While the news cycle remains busy, risk assets, including Bitcoin, are reacting less dramatically to negative headlines. This lull, combined with evaporating rate-cut bets, suggests a continued period of sideways price action unless a significant catalyst emerges.

At present, Bitcoin’s price action is trapped between bearish macro sentiment and an impending shift in labor market dynamics. For investors, this means vigilance is key: while immediate downside risks are mounting, a sudden shift in macro conditions (such as a labor-driven push for Fed cuts) could spark a surprise rebound.

Stay informed with CryptaBlocks’ expert analysis and tailored investment strategies—position yourself for Bitcoin’s next move today!

Ready to navigate market dynamics and optimize your crypto investments?