As Q3 2025 begins, Bitcoin is presenting a complex market structure—one of reduced network activity but record-breaking institutional accumulation. While transaction volume and on-chain activity have slowed significantly, spot Bitcoin ETFs in the U.S. are witnessing unprecedented inflows, reinforcing a narrative of maturing market dynamics.

Volatility and Transactions Dip Sharply

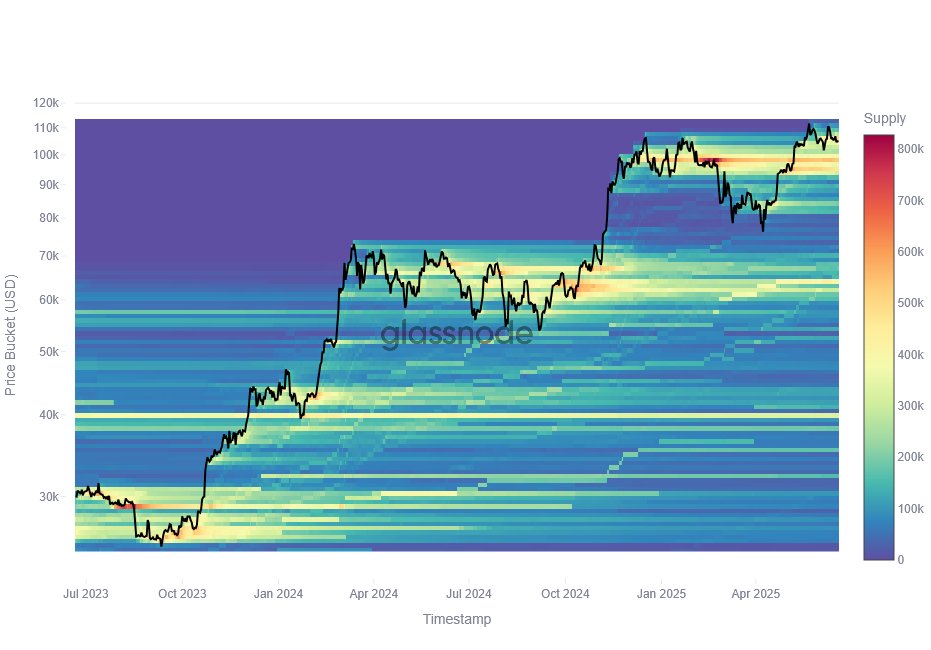

According to new data, Bitcoin’s implied volatility—measured across timeframes ranging from one week to six months—has reached its lowest levels since October 2023. Back then, Bitcoin traded at one-third of its current price level, indicating today’s calm comes despite significantly higher valuations.

Adding to this, June saw a 15% month-over-month drop in transaction count on the Bitcoin network, registering the lowest monthly total in over 20 months. Miners have even begun confirming deeply buried, low-fee transactions from the mempool to fill blocks—clear evidence of a slowdown in retail and smaller-scale user activity.

Institutional Demand Hits New Milestones

In contrast to on-chain dormancy, Bitcoin institutional demand continues to surge. U.S.-based spot Bitcoin ETFs recorded over $1 billion in inflows in just two days last week, bringing total net cumulative inflows to nearly $50 billion. These ETFs now manage $137.6 billion worth of BTC, a new all-time high, according to data from SoSoValue.

Public companies joined the accumulation wave too, with firms acquiring over 65,000 BTC in June alone—equivalent to more than $7 billion at current prices. This behavior underscores a growing trend: institutions and whales are becoming dominant market participants, even as retail activity cools.

Futures Volume Confirms Summer Lull

Bitcoin futures markets are also seeing reduced activity. Lower volume and open interest levels indicate a possible summer lull, historically a slower period for market participation. However, Bitcoin institutional demand and ETF flows may provide a stabilizing force against broader market weakness.

Conclusion: Calm Before the Next Surge?

While low volatility and decreased transaction activity may worry short-term traders, the long-term narrative is shifting. With ETF demand accelerating and publicly traded firms increasing their BTC exposure, this consolidation period could be laying the groundwork for Bitcoin’s next major move.

At CryptaBlocks, we remain focused on interpreting these developments to guide investors toward intelligent decisions and long-term ROI. Whether this is the calm before the storm—or the foundation of a new institutional era—Bitcoin’s next phase is rapidly approaching.

Stay updated with CryptaBlocks for strategic insights into these key inflection points—and how they impact your ROI.

Ready to navigate market dynamics and optimize your crypto investments?